Why do people like making planned gifts?

Planned gifts (most commonly a donation made in your will or trust) cost nothing today and allow you to make an incredible impact, which is why so many people choose to make them.

There are some other exciting but less common gifts — scroll down to learn more!

Popular gifts for the future

See what types of gifts many people choose to make. Many people make these to honor a loved one, to show what’s important in their life.

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will or trust – for free!

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Popular gifts for today

Many people love these donation options because they fit with their personal circumstances and financial goals.

Cryptocurrency

Donate Bitcoin, Ethereum, and more to save on taxes and make a big impact.

Stocks and securities

Many people love donating stock or mutual funds because it may help them avoid paying capital gains taxes.

Qualified Charitable Distributions

Use your IRA to make tax-free gifts that benefit you and our mission.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.

Please let us know if you’ve already included us in your estate plans!

Letting us know is incredibly helpful to our team and helps to make sure your gift is used the way you want it to be.

Planned gifts help to fuel Knox’s mission

We depend on the generosity and commitment of donors who play a vital role in providing sustained financial support for our mission. Planned gifts, such as bequests or gifts from your will, impact the lives of our students and our world for many years to come.They help us make a Knox education affordable to deserving students or all financial means.

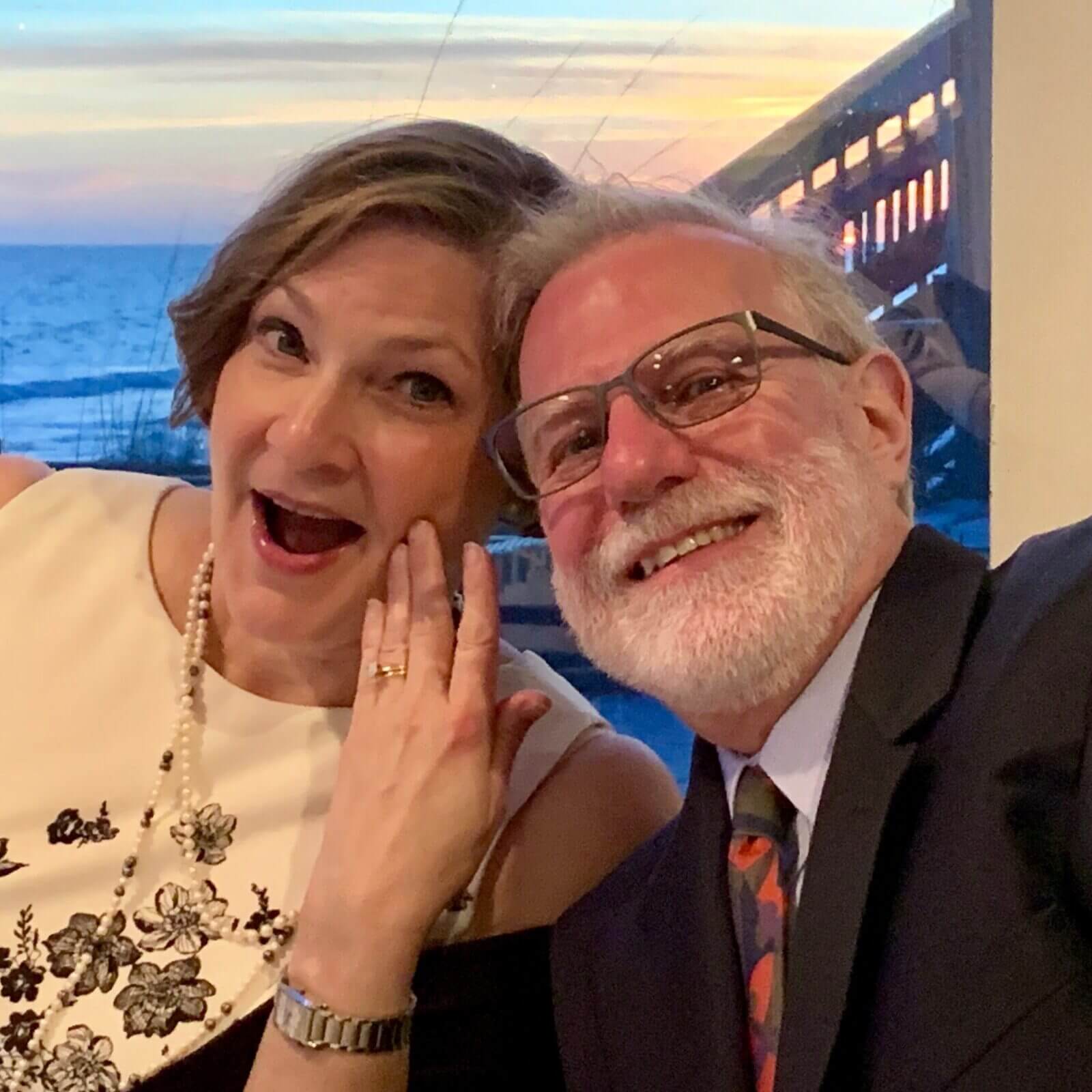

Dee Ann Herring Revere ’79 and Tim Revere’s story

“When Tim and I began our estate planning, there was never a doubt that Knox would figure prominently. It is our way of giving back to both the College and the city.” Tim and Dee have provided for Knox through a testamentary gift, one that transfers to the College after Tim and Dee’s lifetimes.

Read moreFrequently Asked Questions

Yes! Gifts of any size are deeply appreciated. Many people choose to leave a percentage of their estate, which scales up or down with your estate size.

We’ve partnered with FreeWill to help you make a will or trust at no cost to you. You can use this to complete your plans, or you may choose to use the same tools to get your affairs in order before visiting an attorney (who is likely to have a fee associated with finalizing your plans).

Yes. You are always free to revise or update your estate plans.

Yes! FreeWill will never share your personal information without your permission.

Yes. Knowing in advance about your intentions helps us to ensure that your gift is used as you desire, but you can remain anonymous if you prefer not to share the details of your gift.

Make your will today

100% free

Trusted and secure

Done in under 20 minutes

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Paul Steenis '85

Title :Director of Gift Planning

Phone: 309-341-7145

Email: psteenis@knox.edu

Already included us in your estate plan? Let us know